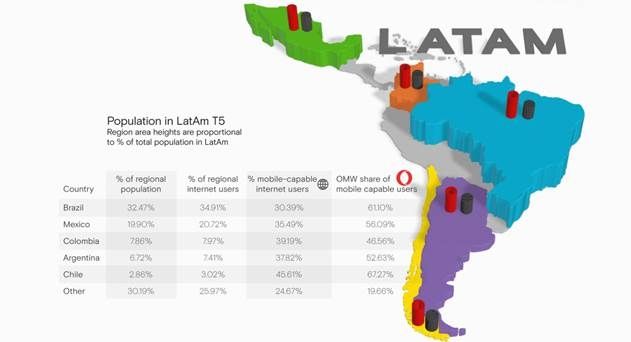

Latin America (LatAm) takes the lead as the fastest-growing mobile ad market globally, now capturing nearly 8% of the market, based on the latest data from Opera Mediaworks’ global mobile ad platform. In addition, three LatAm countries – Mexico, Brazil and Argentina – are now in the company’s Top 10 list of all countries by mobile ad traffic.

The report, which was created in partnership with the Mobile Marketing Association (MMA), showed several distinct regional trends in monetization, ad formats, OS share and mobile media-consumption patterns.

On top of being the fastest growing region globally, Latin America also has the highest monetization potential, compared to other emerging markets (Asia Pacific and Africa). Mobile ads served within the region generate more revenue per impression than either of these two regions, with a ratio of 1 to 0.87 (global average is 1:1), said Opera.

The following are the other interesting findings from the report:

Globally, 55% of ad impressions are delivered within apps, and, in Latin America, that share is lower, at 30% – though partially attributed to the below-average level in Brazil (18%). Still, revenue levels within apps are proportionally higher, at nearly 40% for LatAm overall and over 45% for the LatAm top five countries.

Video ads, with their high engagement rates and revenue capabilities, continue to grow in popularity. Brazil, Colombia and Chile all have high ratios of video impression share to a total impression share of more than 1:1, with Chile is the clear leader at nearly 4:1.

More than 8 out of every 10 mobile users (80.7%) in Latin America have mobile devices with the Android operating system, followed by iOS at 14.1%. While just 5.2% of users are on “other” operating systems (e.g., BlackBerry, Windows, Symbian, Java), the number of impressions per user on these OS’s is significantly higher than the global averages.

Sports is no. 1 for mobile consumption, but not revenue.

In Latin America, mobile traffic (as measured by ad impressions) to Sports sites and apps is nearly 3X that of the global average – 42.1% vs. 14.6%. However, the revenue earned from Sports impressions is not proportionate to the impression volume, hovering in the 10% range.

Gaston Bercún, Co-President, Opera Mediaworks LatAm

Sports might be the most popular category for Latin American mobile consumers, but they tend to seek fast information, like the score of a football match and are less likely to engage in advertising. We found, however, that Entertainment, while having lower traffic volume, monetizes really well because users are in a ‘want’ state and engaging more deeply with the mobile content.

Fabiano Destri Lobo, Managing Director of MMA - LatAm

Mobile is the closest you can get to your consumer, and now we have empirical evidence that allocating your marketing mix effectively also generates better branding, greater buy intent, conversions and sales.