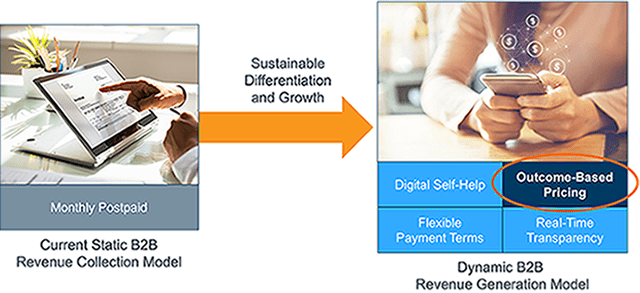

Sustainable differentiation and growth in a fiercely competitive telco B2B market will not be achieved by focusing only on Information and Communications Technology (ICT) portfolios, where change tends to be short lived and easily leapfrogged.

The key to sustainable differentiation in this market is a fundamental shift in the commercial model, from technology-centric offers to a focus on customer business outcomes, resulting in a new, dynamic monetization approach to telco B2B services. This approach is known as outcome-based pricing.

The Evolution of Dynamic B2B Monetization

The Evolution of Dynamic B2B Monetization

What is outcome-based pricing?

Outcome-based pricing (OBP) and monetization models put the focus on business outcomes, where the customer pays for a predefined, tangible outcome or value realized from services consumed.

To date, telco B2B ICT services have been predominantly monetized on a ‘cost plus’ basis that takes the cost of building and deploying a service and adds a margin based on what the market can stand. This approach creates two major challenges. First, cost plus models, by their nature, focus on individual technology elements (bandwidth, QoS, 5G, etc.), a language not easily understood or necessarily valued by business customers. Bundling does little to alleviate this. Second, cost plus models are both value- and margin-dilutive, as any latent value in the portfolio is commoditized at the point of offer through technological focus and positioning.

Examples of Outcome-Based Pricing

The concept of OBP is not new and has been used in many industries. For example, a manufacturer in Europe delivers a ‘Train as a Service’ (TaaS) offer. It builds, operates and maintains the trains and then provides a managed service to the train operating companies who provide the retail service. The train operating companies agree to a commercial contract with the TaaS company based on a number of delivery criteria being met, such as:

- Train availability and maintenance

- Train comfort and onboard services

- Train capacity

- Industry compliance/safety/operating criteria

These criteria are based on metrics the train operating company perceives as valuable to its business and against which the performance of the TaaS company can be measured. It’s a commercial relationship centered on an agreed business value outcome, not the underlying technology of the trains themselves.

In the telco B2B services environment, OBP approaches do not fundamentally change the underlying portfolio or the core network characteristics, but they express them in terms of value recognized by the enterprise customer.

In the earlier example, it’s about quantifying the train comfort and onboard service capability, not the underlying technology of the train. If telcos’ operational and commercial concerns include characteristics such as bandwidth consumption, data volume usage, storage/compute usage, coverage, availability and reliability as examples (aka the train) then aligning them with the metrics of enterprise business value lies at the heart of successful OBP models.

Those models need to be positioned alongside existing offers in the B2B commercial portfolio.

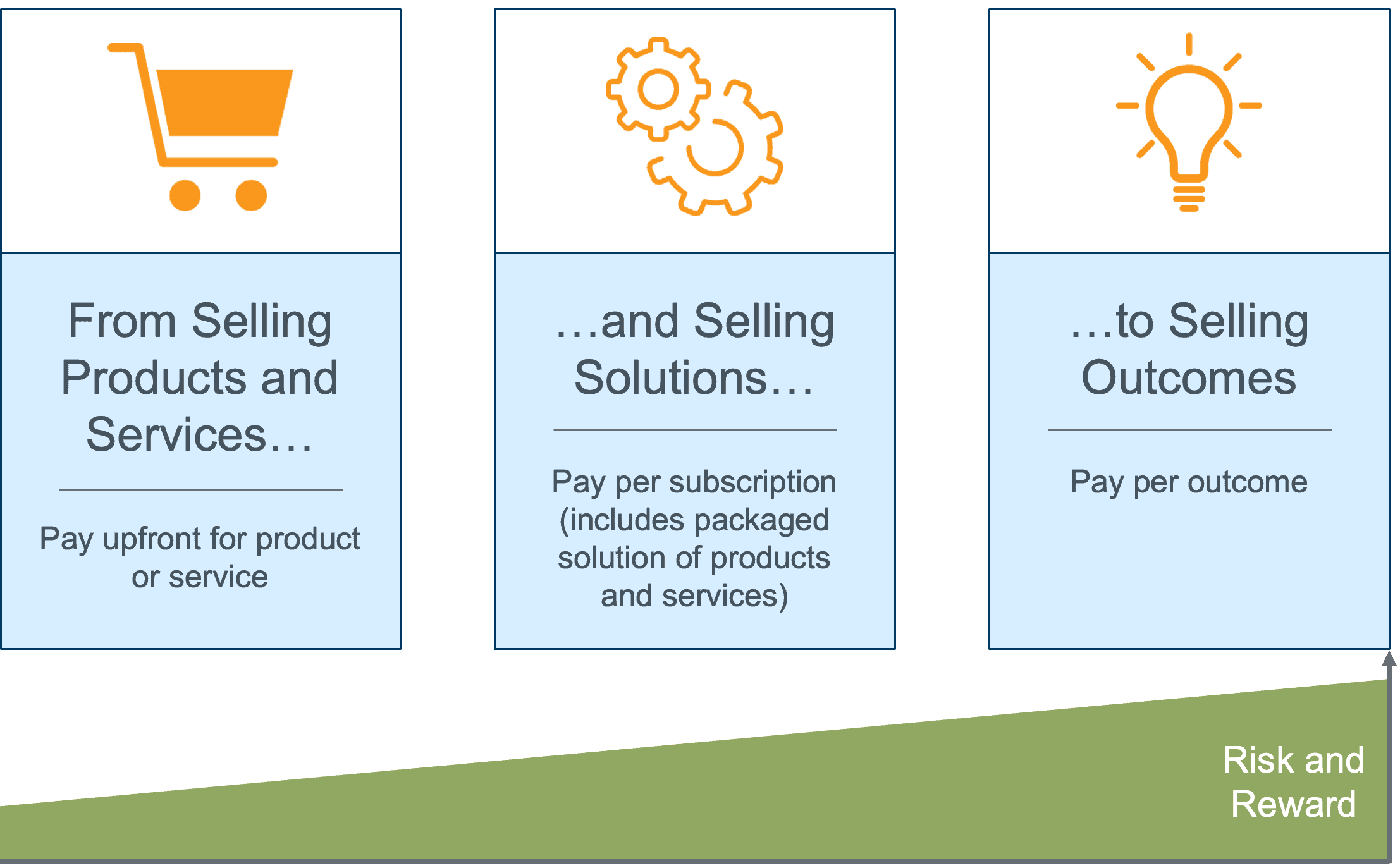

At one end of the positioning continuum, lie generic product and solution offers, broadly targeting the enterprise sector.

At the midpoint are segment-specific bundles targeting Small Office Home Office (SoHo), Small Medium Enterprises (SME), large enterprise or public sector organizations.

Finally, at the other end are OBP offers which are typically (but not exclusively) vertically targeted and angled towards the SME and SoHo segments. This is because SoHo and SMEs are time-poor with little IT expertise and have little understanding of technology-centric offers; and because business value-based offers increase in value through being tied to the specific business of the customer. Vertical targeting achieves that.

An example set of business value elements that could form the basis of a telco B2B business-outcome type offering include:

- Compliance

- Security

- Productivity

- Transparency

- Availability

- Access

- Performance

- Consistency

Monetizing outcome-based pricing services

Many surveys of telcos’ enterprise customers point to a recurring need for more business value-led offers, less technology and much greater flexibility, transparency and pay-as-you-go aspects to the commercial model. Squaring those desires with the telco concerns expressed earlier drives the need for a new and more dynamic B2B monetization approach, with OBP being a key element.

It is most likely that OBP-based offers will be targeted to vertical industries. As an example, a service offering to small to medium legal companies, let’s call it ‘LegalNet,’ would consist of a number of the elements outlined earlier. Crucially within that offer, there would be no expression of fiber, SD-WAN, 5G, UCaaS, etc. While they might be the delivery technologies, they would be hidden behind outcome metrics such as security, availability, transparency and performance.

The specific monetization of the ‘LegalNet’ service offering could then be based on one of the following examples:

- A pure subscription model, based on outcome metrics agreed and monetized over a contractually determined period. The service would be delivered and self-administered via a digital marketplace, allowing the user real-time service insights and the ability to make flexible payments and purchase other portfolio offers. Though this is the simpler of the two models, it may come across as unimaginative and not meet the expressed desire of many enterprises for more flexible, usage-based commercial models.

- A more imaginative approach is ahybrid, usage / subscription model, where a contracted subscription element covers the costs of infrastructure deployment. The usage element comes into play based on apportioning a data usage tariff against the key elements offered (security, availability, transparency and performance, as examples) and applied across single mobile users, telecommuters, office locations and, if necessary, roaming. This hybrid model would then be both delivered and self-administered by a user digital marketplace. This approach directly meets the needs of enterprises for commercial flexibility and transparency, introduces a usage-based component and gives direct spend control, usage insights and flexible payment capabilities via the digital marketplace.

Productivity and transparency metrics are foundational anchors for the overall ‘LegalNet’ service as they are the means through which the customer can track compliance against metrics and control what services they use. It also allows them to track real-time spending and usage insights and offers flexible payment terms such as pay now.

From technology-centric, commoditized, ‘me too’ offers to a sustainable, differentiated and margin-rich offering driven by business value, OBP will be a key weapon in a new dynamic monetization approach to telco B2B services.

A new and dynamic approach to B2B monetization

Outcome-based pricing is a core element of a new and dynamic approach to B2B monetization, supporting the need for sustainable margin and growth. With enterprises demanding more commercial flexibility, agility and transparency from their single largest IT budget spend (communications services), and telco B2B teams under increased pressure to grow (with consumer markets relatively flat), change is needed. Continuing with established commercial models and approaches that offer very little differentiation in a fiercely competitive market is not an option.