-

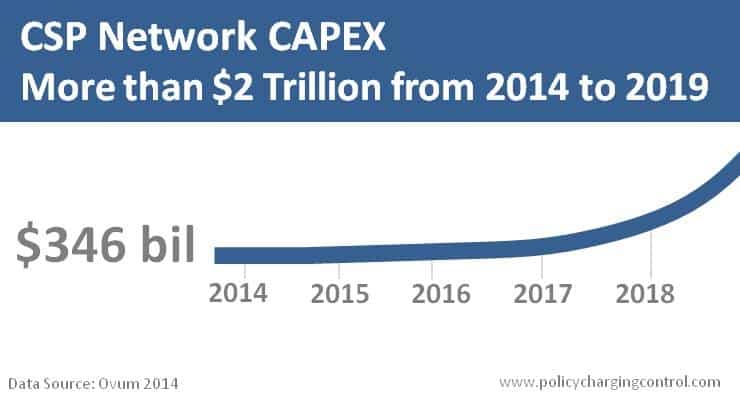

In its latest report 'Communications Service Provider (CSP) Revenue & Capex Forecast: 2014‒19', Ovum said that the telecommunications network capex will turn the corner in 2018 after a period of stagnation. According to the global technology research and advisory firm, for the next 3 years until 2017, the capital expenditure on networks is expected to hover around USD$346 billion. The turnaround expected in 2018 will be attributable to a new wave of fixed broadband, fixed cloud/data center and mobile broadband upgrades in major markets worldwide. Over the next 5 years, communication service providers(CSPs) will spend more than USD$2 trillion on network capex, said the report.

-

At present, fixed communications service providers (CSPs) make up about 41% of the total expenditure while mobile operators account for 59% and over the immediate term, the total expenditure by mobile operators will continue increasing, but the increase will be offset by the decline seen in the fixed segment. Ovum highlighted the need for service providers - fixed and mobile - to continue looking out for new technologies and solutions to keep up with the increasing demand for network capacity. In recent years, the consumption of data specifically rich content has continued to put a strain on today's networks, requiring optimization solutions and bandwidth saving methods that can assure more people continue to be served while service quality levels being maintained. Despite 4G and 4G LTE becoming more widespread, operators in some regions are facing challenges from (a) stiff competition that has been putting downward pressure on data rates and (b) the sharp increase in the traffic that they deliver on their networks as subscribers continue to add more devices to their plans and go on to use data for more daily functions - on fixed, cellular and Wi-Fi connectivity. More importantly, as service providers move towards positioning themselves as digital service providers, the quality and customer satisfaction on the content and applications they deliver become key in retaining their market share.

-

Based on the report, CSPs have been reinvesting an average of nearly 18% of revenues per year into capex, and Ovum projects the ratio to ease slightly to 17.4% during the forecast period. Ovum noted that CSPs have embarked on a number of strategies to optimize their network capital expenditures including network sharing, citing that by the end of September this year, the number of network and tower sharing projects reached 100, a 32% increase compared to last year. CSPs are also adding software intelligence into their radio infrastructure, which is expected to lower the initial capex requirements of radio upgrades, as well as in other parts of the network including optical transmission and fixed broadband equipment. Network virtualization is another strategy most CSPs are deploying as means to lowering both operational and capital costs in the long run.

Matt Walker, Report Author and Principal Network Infrastructure Analyst

CSPs have invested fairly heavily in 2013–14 across both fixed and mobile networks to support broadband rollouts. But this capacity will be absorbed, and technology and feature upgrades will drive capex back up to about $354bn by 2019. Over the entire 2014–19 forecast period, CSP capex will total over $2tn.....While CSP capex is tightly constrained, adjacent markets are starting to invest heavily in networks. Internet content provider (ICP) capex will reach nearly $57bn in 2014, up from $18.3bn five years ago. We expect network capex from the ICPs – which include Google, Apple, Facebook, Alibaba, and many others – to continue growing over the next few years. These providers represent an attractive growth market opportunity for vendors selling technology.