By 2019, 292 exabytes of data will be crossing our mobile networks, up from 30 exabytes in 2014. That is equivalent to 65 trillion images (e.g., multimedia message service or Instagram) – 23 daily images per person on earth for a year; or 6 trillion video clips (e.g., YouTube) – more than two daily video clips per person on earth for a year. These and other related data were published in the Cisco® Visual Networking Index™ (VNI) Global Mobile Data Traffic Forecast for 2014 to 2019, an annual report that covers key trends in data networks. For mobile operators, the latest VNI report highlights 6 major mobile traffic trends that will be influencing their monetization, network management and service delivery strategies in a big way and these trends are:

1. The Surge in Smart Mobile Traffic - According to Cisco, the global smart mobile traffic is expected to rise from 88% in 2014 to 97% by 2019. Cisco attributes the high share of smart mobile traffic to the phenomenal rise in the use of tablets, laptops with tablet-like capabilities and most importantly, the global shift from basic feature phones to smartphones.

What's the Implication?

Smart devices become the essential communication and information transfer devices. Mobile Operators have to tailor their services bearing in mind that whether it is mobile money service, VoLTE or VoWiFi calling, traditional voice and SMS, web browsing, location based service offers or music streaming, these small, keyboard-less devices are where most people will be accessing all these services from. As chip making technologies become more advanced, and start boasting more capabilities, the functionalities offered on these devices will give birth to newer type of 'mobile' services that operators can capitalize on, by being part of the value added services ecosystem. Enhanced cameras on these smart devices and the capabilities to process rich media files for example, have resulted in more and more people recording, sharing and streaming videos from the cloud and this has paved way for Mobile Operators to introduce their own OTT video and mobile TV services. (read more: From Snacking to Serious Viewing - How Tablets and Smartphones are Replacing Traditional TVs). With every new feature or enhancement on smart mobile devices, corresponding applications are being developed and new service layers come into play, expanding the opportunities for Mobile Operators to tap into newer revenue segments.

2. Global Mobile Traffic Growth will Surpass Fixed Traffic Growth - On the back of widespread use of mobile devices, the increase in the demand for personalized content consumed on devices such as smartphones and tablets and the increase in 3G and 4G LTE coverage, Cisco expects global mobile traffic to grow three times higher over the 2014-2019 period compared to the growth of fixed traffic. Cisco said that there will be 5.2 billion mobile users in 2019 compared to 4.3 billion in 2014, making up 69% of the world population by then compared to 59% in 2014. At the same time, Cisco estimates that by 2019, there will be 11.5 billion mobile-ready devices/connections of which 8.3 billion will be personal mobile devices and 3.2 billion will be M2M connections (up from 7.4 billion total mobile-ready devices and M2M connections in 2014).

What's the Implication?

This means that more people will be accessing the internet and online services via mobile connectivity. Either it is via their smartphones, tablets, connected car display screens, their smartwatches or any other device connected to the cellular network, it means that Mobile Operators will have to ensure that their connectivity services are highly optimized to the network type, traffic conditions, device types, user preferences, user data plans and more importantly, the nature of the digital content/service that is delivered such that they provide a consistent, reliable and satisfactory user experience at all times. The fact that more people will be turning to mobile also means that there will be a surge for services previously conducted over fixed networks, for example, in place of IPTV, mobile TV and LTE multicast service will emerge, VoIP will give way to VoLTE, popular online sites will see mobile apps spin-offs and at the far end of the spectrum, there will be emergence of mobile-only services - from the fast growing NFC-based payment services to Instagram type applications. What this implies is that there will be more business for Mobile Operators, especially for those moving into the digital services sphere, expanding their offerings to verticals such as m-commerce, digital services and contextual services.(read more: OTT TV and IPTV: Dual Opportunities for Operators in the Fast Growing Video Services Market)

3. Wearables will Fuel 18-fold Growth in Mobile Traffic - With mobile wearables projected to grow five-fold from 109 million last year to 578 million in 2019, the amount of traffic generated by these devices will form a large bulk of data traffic, said Cisco, pointing out to the fact that in 2014, the average wearable device generated 6X more traffic per month than a basic handset while the average M2M module generated three-times more traffic per month.

What's the Implication?

The implication is straightforward. Device plans must now include the entire variety of wearables that are currently in the market and also those that will enter the market over the next few years. Device plans must be innovatively crafted to encourage more people to extend their shared plans to include these devices. Content delivered specifically to and from these devices must be optimized so as to avoid degradation of the overall network service quality, especially across M2M devices that transmit huge amounts of data over the network. This may necessitate investments and partnerships with M2M connectivity service providers, such as Sigfox, to help offload all the light M2M traffic while reserving 3G and 4G LTE networks for the transfer of larger files/data. Wearables also come with their own app stores, and Mobile Operators may be looking at digital content opportunities (app stores for health wearables or app stores for smartwatches) for these market verticals.

4. Trafic Offloaded to Wi-Fi Surpasses Cellular Traffic - Cisco expects 54% of total mobile data traffic to be offloaded in 2019, compared to 46% in 2014.

What's the Implication?

Packaging Wi-Fi into existing mobile data plans could open up new revenue opportunities for Operator Wi-Fi services. Applying policy rules and allowing mobile data subscribers to offload their mobile traffic via Wi-Fi quota and special Wi-Fi rates will attract more users to sign up larger data quotas and could also spur the take-up on Wi-Fi-only device plans. Mobile Operators are expected to establish partnerships with Wi-Fi service providers and expand their Wi-Fi service presence in almost every city and town as the trend toward Wi-Fi offloading continues, especially with the advent of VoWiFi services to complement VoLTE.

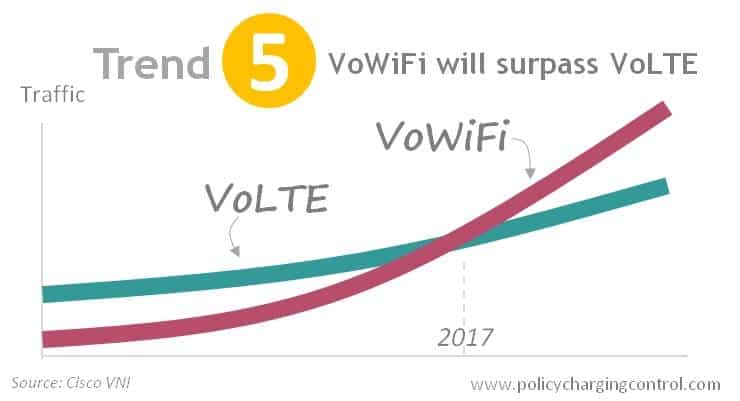

5. Voice-over-Wi-Fi to Take Over Voice-over-LTE (VoLTE) - According to Cisco, by 2017, VoWiFi traffic (10.8 PB/year) will exceed VoLTE traffic (10.7 PB/year) and in 2018, it will exceed VoLTE in the number of minutes used per year. By 2019, VoWiFi minutes of use will account for more than half – 53 percent – of all mobile IP voice traffic.

What's the Implication?

Combining VoLTE and VoWiFi, Mobile Operators can offer unbeatable value proposition for their Voice-over-IP services, allowing their mobile subscribers to offload their voice calls as soon as they enter a Wi-Fi zone. With VoWiFi, Operator VoLTE service will actually provide users cheaper means of making high quality voice and video calls, and will help Mobile Operators monetize their LTE networks. VoLTE and VoWiFi combo will be instrumental in the development of rich communication services that will include conference calling and video messaging, as it onboards more people to communicate in real-time via data connectivity using the native call and messaging applications on their handsets.

6. Mobile Cloud-based Applications Take the Lion's Share of Mobile Data Traffic - Cisco expects cloud applications and services to account for 90% of total mobile data traffic(21.8 exabytes/month) by 2019, growing from the current 81%.

What's the Implication?

Mobile Operators can start their own apps stores, and many have started doing so because the demand for apps will continue rising as more and more people turn to mobile data for internet access. Local content is one area where Mobile Operators can easily take lead, by signing up partnerships with local content providers or working with app developers to develop their own suite of applications. Mobile Operators are also developing their own app ecosystems, nurturing new players and onboarding well known brands to enrich their own digital services offering. With more connected screens coming into play, for example the digital screens in Connected Cars, Mobile Operators can expand their app store and app offerings for more specialized customer segments. By combining connectivity with mobile app offers, Mobile Operators can expect to improve their ARPUs and margins while expanding their customer base. (read more: Mobile Apps Beat Network Speeds, Data Coverage and Cheaper Handsets to Become the Biggest Driver for Mobile Data Traffic Growth.)

Apart from these trends, Cisco's VNI report says that by 2019, 4G will account for 68% of total mobile data traffic and will be generating on average 5.5 GB of mobile data traffic per month, 5.3 times higher than the 1.04 GB/month for the average non-4G connection. In terms of regions, Middle East and Africa and Central and Eastern Europe boast the highest expected mobile data traffic growth rates by 2019 at 72% CAGR and 71% CAGR. Asia Pacific follows at a distant at a CAGR of 58% but is expected to rank highest in terms of mobile data traffic generation with 9.5 exabytes of data generated per month by 2019 followed by North America at 3.8 exabytes per month by 2019.