Digitalization of content broke almost every barrier of entry there is for the content distribution industry, specifically in the market for video and TV services. Digitalization meant that all forms of content (print, audio and video) can now be delivered via the Internet, and all that matters is whether there is enough capacity on the fiber and mobile networks to enable this content to reach the digital screens they are being accessed on.

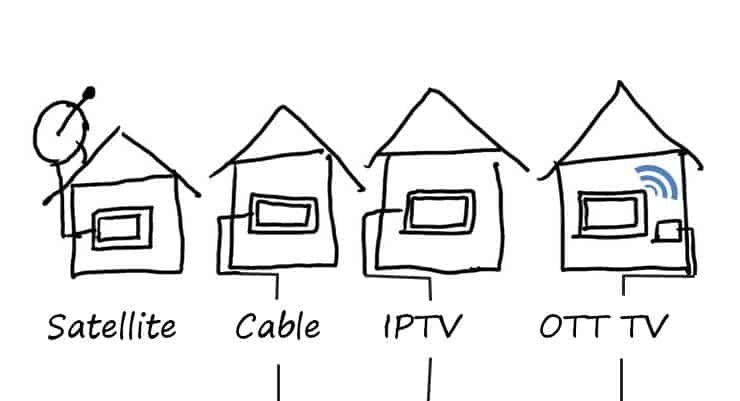

In recent years, players in the traditional broadcasting space such as cable operators and satellite operators saw digital content delivered by IPTV operators and OTT TV service providers eating into their market share. OTT TV service in particular recorded rapid growth in the last two years and is projected to continue expanding at this space. Infonetics projects OTT TV service revenue to grow from US$5.8 billion in 2014 to reach US$10 billion in 2018, outperforming the growth in the cable TV, satellite TV and IPTV markets. Similar trend also took place in the video segment. Video-on-demand service provided by IPTV providers and OTT video service providers such as Netflix, Hulu, Vudu and Amazon's Prime not only wiped out the traditional video rental stores, they also took a good chunk out of the market for on-demand videos offered as an add-on on cable and satellite TV services.

It is hard to dispute the value proposition of OTT services primarily because they ride on the Internet which means that anyone who accesses Internet can start consuming OTT content and services and because it is inherently multiscreen. Anyone from anywhere from any connected digital screen can access any digital content that is delivered on the OTT application. Digitalization of content and the emergence of new, customizable, easy to download and use OTT applications brought together the two biggest forces in the digital world and transformed the whole content distribution industry.

With OTT TV and video services, subscribers can now access a wide range of entertainment and information content independent of their cable, fixed broadband and satellite connectivity. Service providers are already tapping into the OTT TV and video market, launching their own TV and video services, delivered either on fiber or via OTT applications. One of the recent launches of operator OTT TV services is the launch of Tele2 Russia's OTT TV - Tele2 TV - a TV service that costs only 7 rubles(US$0.11) per day and which can be accessed via its downloadable Android App. Tele2 has over 34 million customers in 10 countries and the service allows its mobile subscribers to watch favorite TV programs and movies on their smartphones and tablets without paying extra for the mobile data charges in areas with 3G/4G coverage. Another operator who has recently launched OTT TV service is Cellcom Israel, Israel's largest cellular operator. Cellcom's Cellcom tv service is a multi-screen Over-The-Top (OTT) TV and Video on Demand (VoD) service that brings customers access to premium movies from major Hollywood studios, such as Sony Pictures, NBCUniversal and Disney apart from a wide variety of other channels, and is offered on a monthly subscription plan. A similar OTT TV service has also been launched recently by T-Mobile Czech.

At the same time, operators are also beefing up their IPTV offerings. Large service providers such as Telstra in Australia and Proximus in Belgium are expanding their existing IPTV services with Video On Demand features and are launching OTT TV services to make their IPTV channels and content available over the Internet. While IPTV services are currently the domain of quadplay operators with their own fiber connectivity as well as those with partnerships with existing cable operators who allow broadband content to ride on their infrastructure, mobile operators with established OTT TV services may lease the same infrastructure to also expand their TV services by providing their OTT TV content as an IPTV service, enabling their subscribers to access the content on fiber, hence lowering the delivery charges and capitalizing on the content they already have the rights to distribute.

IPTV, OTT TV and OTT video services will all be redefining the TV experience, and more importantly will be seeing a large number of telcos expanding into the TV and video services market. On one end, households are doing away with their TV sets in favour of streaming on their smart devices, and on the other, households are buying more streaming devices to bring the content they see on their phones and computers to their TV sets. According to a recent research from Parks Associates, 26% of US households already own a streaming media device and more than one third own a smart TV. Parks said that on average, a US household spends over US$6 per month on subscription of Internet video services which means that despite having cable and IPTV, consumers are paying extra to access more content on the Internet. With more people finding their favourite content online and with the preference among users to merge all their connectivity infrastructure on fiber (as opposed to having a separate cable or a satellite connection), quad-play operators and mobile operators both stand to benefit from the shake-up in the video delivery market.

Read More:

OTT Video Services Popular Among US Households, Operators Targeting Cloud-based Offerings