Mobile subscribers in Europe spent less on their mobile services in 2013 compared to the year before. The negative growth in mobile service revenue in a market that has reached saturation and that is plagued with a sluggish economy, is prompting major operators in this region to push for consolidation in the sector.

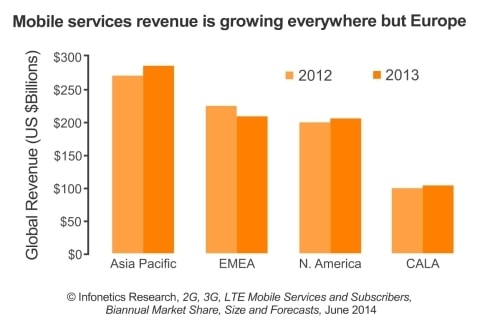

Consolidation is expected to help mobile operators improve their revenues, as the market heads towards commoditization with downward price pressures and competition from over-the-top(OTT) players, both of which will be eroding their margins further. Infonetics Research, a global research firm specializing in telecommunications, via its report, the 2G, 3G, LTE Mobile Services and Subscribers Market Size and Forecast, reported that mobile operators globally raked in $800 billion in revenues in 2013 from mobile services which cover the mobile voice, SMS/MMS and broadband, which is just a 1% increase from the preceding year. More interestingly, other regions namely Asia Pacific, the Caribbean and Latin America recorded growth rates of 5%, 4% and 3% respectively - offsetting a high single-digit decline in EMEA, resulting in the overall weak global growth for the sector.

Highlights from the Infonetics report include:

-

Mobile broadband fueled overall mobile service revenue growth in 2013, offsetting year-over-year decreases in voice and SMS revenue

-

Despite the rise of mobile data, blended ARPU continues to fall or, at best, stay flat in every region except developing Asia Pacific, where it rose slightly in China

-

Mobile broadband subscribers are expected to exceed the postpaid voice subscribers by the end of 2014

-

Voice services are expected to stay above 50% of total mobile service revenue through 2016

-

Mobile broadband revenue is forecast to grow at an 11.8% compound annual growth rate (CAGR) from 2013 to 2018

-

LTE services are expected to account for half of total mobile broadband service revenue in 2018, with North America making up the majority

"Europe dragged global mobile service revenue again in 2013, plagued by mobile saturation and weak consumer spending across the board—even in Germany, the euro zone’s largest economy—and fierce price-based competition in markets including Belgium, France, Italy, Spain, and The Netherlands. .... At this point, the CEOs of Europe’s BIG 5—Deutsche Telekom, Orange, Telecom Italia, Telefónica, Vodafone—are pushing the European Commission for more consolidation to reduce the number of operators in each country, from four or five to just three. The hope is this will restore operators’ revenue growth and margins, similar to what we saw in Austria.”

- Stéphane Téral, Principal Analyst for Mobile Infrastructure and Carrier Economics, Infonetics Research