According to the Strategy Analytics Wireless Operator Strategies (WOS) service report, consumers expect more contextual, personal interaction from brands, when and where they want it, as experiences today are shaped by leading digital native brands like Facebook, Google, Uber, Amazon, WeChat and other digital giants.

Failure to become more customer centric and offer improved digital engagement leads to risks of losing subscribers, missing opportunities for revenue growth through new digital service offerings and earning poor customer satisfaction ratings leading to weaker market positioning and brand perception.

Typically, CSPs in developed markets spend 10-15% of service revenue on customer acquisition and 2-3% of revenue on customer service. The benefits that a more agile and customer-centric experience can deliver not only drive up sales conversion rates but can also reduce churn and reduce call load at customer service centers. These cost structures provide significant room for efficiency gains.

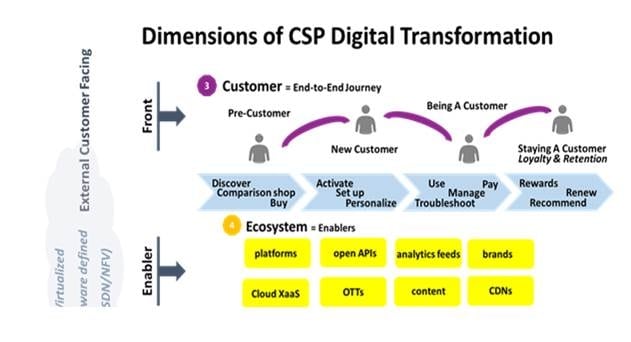

Strategy Analytics believes digital transformation gains relating to customer-facing costs in the range of 2-3% of service revenue should be targeted, with further upside potential in revenue from cross-selling and up-selling products and features and further operational efficiencies.CSPs seeking to increase digital engagement with their users need to also consider interrelated dimensions of digital transformation, including strategy and organizational culture and structure.

While it is important to address organizational and strategy areas to implement digital transformation, CSPs may want to introduce new agile cloud-based solutions to support the operational dimension needed for digital customer engagement, rather than start with a more lengthy upgrade and transition to the entire set of legacy OSS/BSS solutions;

Susan Welsh de Grimaldo, Director, Operator Strategies said: “Digital customer engagement through digital transformation is not just about going after digitally savvy Millenials. CSPs have an opportunity to focus beyond the early adopters on the next wave of users—for example the broader family, the small enterprise—by adding value and incentives for digital engagement plus ease of use, security and privacy. CSPs need to handhold these users up the ladder of digital engagement, “spot” them and train them as they learn new skills and build comfort—driving both cost savings for the CSP and value and satisfaction for the customer.”

Sue Rudd, Director, Networks & Platforms added: “Great network infrastructure is table stakes but no longer enough to succeed and differentiate. The network needs to become a key enabler as CSPs change their focus to how they enhance the customer’s digital lifestyle, both consumers and enterprises, as well as small businesses.”

Phil Kendall, Executive Director, Operator Strategies, commented: “Customer centric digital engagement should target key KPI improvements that impact the bottom line; for example, a one percentage point improvement in churn would reduce customer acquisition costs by an amount equivalent to 0.5% of service revenue, with a similar scale of saving available from a 20% reduction in calls to customer care.”