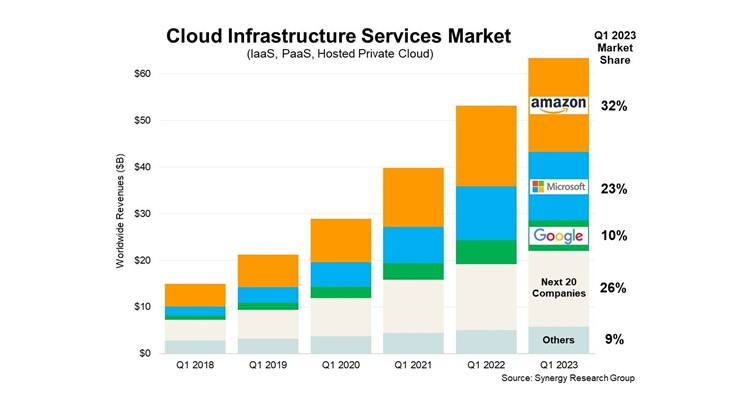

New data from Synergy Research Group shows that Q1 enterprise spending on cloud infrastructure services exceeded $63 billion worldwide, up by over $10 billion from the first quarter of last year. The year-on-year growth rate was 19% in Q1. While this is well down from previous years, it was similar to the level of growth seen in the previous quarter. Q1 spending was up by 3% from Q4, not dissimilar to the quarter-on-quarter growth rate seen in Q1 of last year.

Among the largest cloud providers Microsoft and Google had the stronger year-on-year growth numbers, resulting in both increasing their worldwide market share by a percentage point from the first quarter of last year. Their Q1 worldwide market shares were 23% and 10% respectively. Meanwhile market leader Amazon stayed within its long-standing market share band of 32-34%, though at the bottom end of that range. In aggregate the three leaders accounted for 65% of the worldwide market. Among the tier two cloud providers, those with the highest year-on-year growth rates include Oracle, Snowflake, MongoDB, Huawei and the three main Chinese telcos.

With most of the major cloud providers having now released their earnings data for Q1, Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $63.3 billion, with trailing twelve-month revenues reaching $237 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 21% in Q1. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 72% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world. When measured in local currencies, North America, APAC and EMEA regions all grew by well over 20% year over year.

Economic pressures are crimping cloud spending in some quarters, but the foundational benefits of cloud adoption continue to drive the market to ever-higher levels. The large Chinese cloud market has also returned to growth, though it is the telcos who are benefitting more than the traditional main internet companies. And, as the US dollar ulls back from its recent historic highs, that now provides some tailwinds for cloud growth metrics in the EMEA and APAC regions, which together account for over half of the world market.