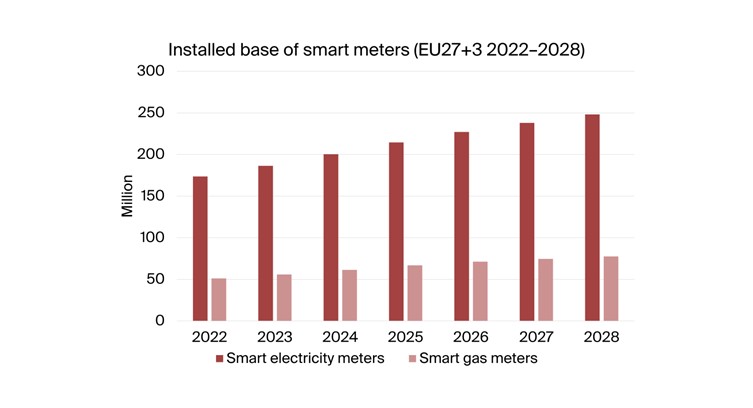

Berg Insight last Friday revealed findings form its latest study of the European smart metering market. According to the study, more than 60 percent of the electricity customers in EU27+3 had a smart meter at the end of 2023. The market is set for stable growth with a total of more than 88 million smart electricity meters forecasted to be deployed across the region from 2024–2028. At the end of 2023, the EU27+3 region was home to more than 186 million smart electricity meters. Growing at a steady CAGR north of 6.1 percent, the installed base of smart electricity meters is expected to reach a penetration rate of 78 percent by 2028, driven by second-generation rollouts in countries such as the UK, Italy, Spain and Sweden alongside first-generation projects in Germany, Poland and Greece. The smart gas metering market is also set for robust growth in the EU27+3 region where the installed base of devices is forecasted to increase from 56 million units in 2023 to around 78 million units by 2028.

The composition of smart electricity shipment volumes is anticipated to change in two important ways, indicating a focus shift away from Western European markets which have historically been at the forefront in terms of smart metering deployments.

In the last years, the smart metering market has also undergone a shift related to the type of communications technologies being used for data exchange with the utility’s back office. Standalone wireless connectivity options have grown considerably in popularity in the past years and will account for between 55–65 percent of annual shipment volumes throughout the forecast period.

Source: media.berginsight.com/2024/02/16191446/bi-sm18-ps.pdf

Mattias Carlsson, IoT Analyst at Berg Insight

Firstly, first-generation electricity meter shipment volumes will account for 67 percent of total shipment volumes throughout the forecast period, as second-generation rollouts in Western Europe are by now either in their final stages or fully completed. Secondly, the share of first-generation shipment volumes to countries located in the CEE and SEE regions will increase from 50 percent in 2022 to 80 percent in 2028. Most of the growth is attributable to 3GPP-based LPWA connectivity options, which are now available in most European markets. Annual shipments of NB-IoT and LTE-M electricity meters are forecasted to be at a level of 3.5–4.0 million per year during the forecast period.