Aximetria, a Swiss-based fintech startup develops a new private keyless voice authorisation technology for mobile banking that that obviates the need for private key generation.

Currently, there are many different crypto-wallets on the market and each of them is built on a particular method of storing and working with private keys. The basic principle of operation of any wallet is remote or local storage of a private key, followed by password protection and/or additional physical protection.

The classical approach (besides the question of trust to the remote storing) has at least one major drawback: if you forget your password or lose it, access to the wallet can be lost forever. This problem can be solved by using the protection factors of the user’s biometric information, like voice, claims the company.

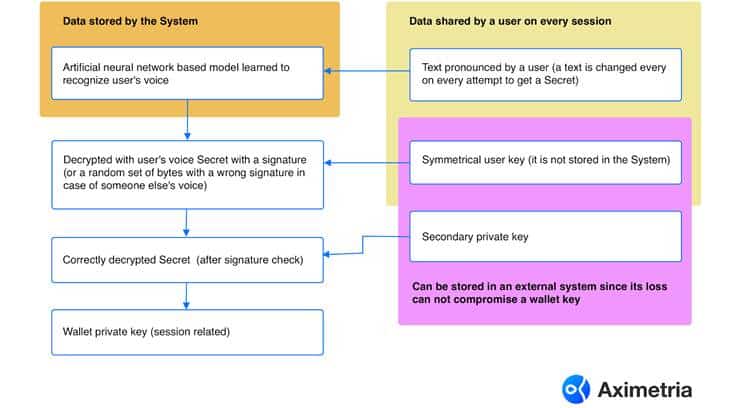

In the case of the use of biometric identification technology, the accuracy of which is high enough for 100% error-free identification, it is necessary to use a database of voice samples - which can also be compromised or attacked. Aximetria’s method, however, does not store voice samples. It preserves the possibility of identification through the use of a two-level neural network, with the help of which the identification first takes place and then the private key is generated.