The global macrocell mobile backhaul equipment market totaled $8.4 billion in 2015, growing 5 percent from the prior year, according to market research firm, IHS. IHS is forecasting an accumulation of $51 billion in spending on mobile backhaul gear over the six-year period from 2015 to 2020.

According to IHS, the largest mobile backhaul equipment spending category in 2015 was microwave radio, comprising 44 percent of worldwide revenue. The microwave radio segment is projected to decline a little over the next couple of years as more fiber and wireline Ethernet come into play; however, the segment will get an injection of momentum towards 2019 when LTE-Advanced Pro and early-stage 5G backhaul demand starts to drive the market, said IHS.

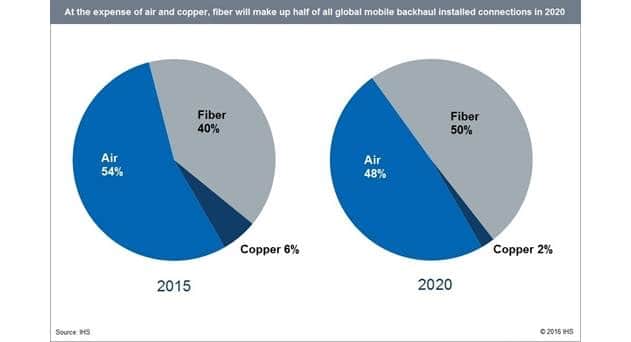

At the same time, Ethernet access devices (EADs) and IP edge routers together represented 45 percent of global macrocell backhaul revenue in 2015. Growing LTE and LTE-A deployments are fueling Ethernet macrocell backhaul spending, with the market dominated by Ethernet over fiber or microwave.

Richard Webb, Research Directir for Mobile Backhaul and Small Cell, IHS

Although the exact long-term 5G picture for backhaul is unclear at present in terms of form factor, in the long run there must be fiber or other high-speed solutions available out at the network edge, locally, close to cells, due to the very high-capacity spectrum used for high-capacity service delivery with low-latency requirements.