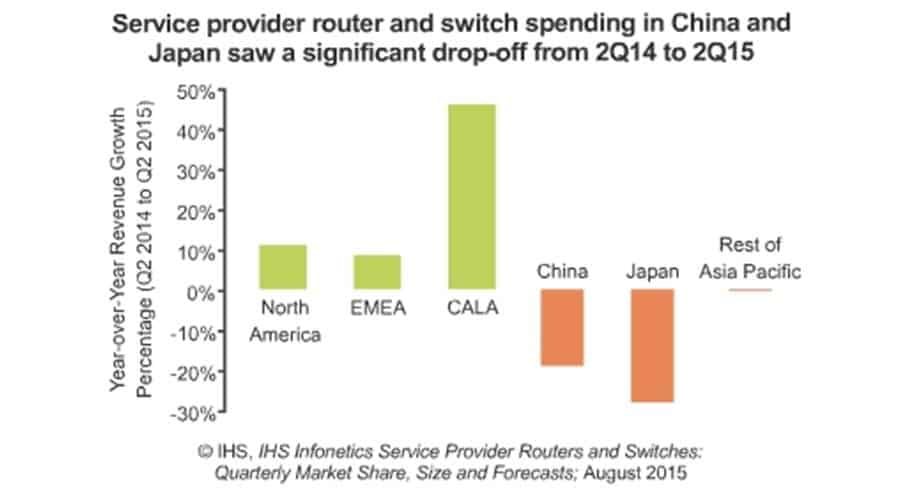

The global service provider router and switch revenue spiked 19 percent in the second quarter of this year to $3.9 billion, according to the IHS Infonetics Service Provider Routers and Switches report. The carrier switching and routing revenue segment which comprises IP edge and core routers, vRouters and carrier Ethernet switches (CESs) was up in all major geographical regions this quarter compared to a year ago, with the exception of Asia Pacific, which saw a decline of 16 percent.

With the SDN hesitation slowing router and carrier Ethernet switch spending, IHS is projecting the worldwide service provider router and switch market to grow at a 2.0 percent compound annual growth rate from 2014 to 2019.

In terms of top vendors for the segment, the report lined up Cisco as the market leader, followed by Huawei, Juniper and Alcatel-Lucent in the second, third and fourth position respectively.

Michael Howard, senior research director for carrier networks at IHS

While the SDN (software-defined networking) hesitation that we've been talking about the past many quarters is still in play in the carrier routing and switching space, core router upgrades and replacements prompted by the move to 100GE contributed to a nice uptick in the second quarter.