PwC's recent report 'Capex is King: A new playbook for telecom execs' highlights the need for telecom operators to start looking into revamping their existing capital expenditure decisions in response to the industry's financial performance. The report addresses the revenues lost by telecom operators to OTT voice and messaging services and the overall lacklustre performance of telecom operators in some major markets due to increasing commoditization of telecom services and the continuous capital outlays made by operators to expand their networks, including LTE and LTE-A. At the same time, the transition to network functions virtualization and the need to increase the capabilities to manage increasingly innovative product/service offerings require operators to continue investing in newer solutions and technologies.

PwC highlighted that while the era of digital services will open up new revenue opportunities for service providers, these new revenue channels are still in their infancy - mobile advertising is expected to contribute US$30bn, cloud services another US$35 billion and M2M a sum of just US$13 billion - when total telecom revenues have exceeded US$1.2 trillion in 2014.

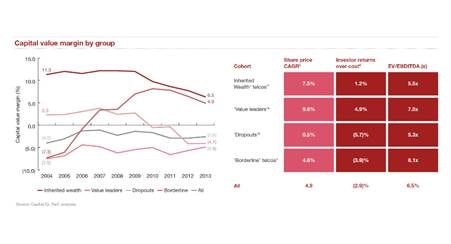

PwC says that this necessitates mobile operators to change their earnings strategy by optimizing their capital expenditures - in the past operators manage capex based on historical context, and with expectation that revenue would repeat year over year, based on the assumption of increasing traffic. This however is changing, where in order to succeed, PwC noted that telcos need to center on more in-depth analysis when it comes to capital expenditures (Capex) including looking into every segment, product and price plan that will drive ROI in each operational company (opco). PwC added that capital allocation to each opco, which may appear stable over time, needs to be evaluated to determine how the ROI spread expected to change over time and how the capital allocation reflects that.

Pierre-Alain Sur, Global Communications Industry Leader, PwC

In the old days, telecoms could rely on strong revenue growth and EBITDA to provide premium EBITDA multiples. Today, we have segments like fixed lines in absolute decline and others like mobile that are expected to decline. Telecoms need to set aside their focus on EBITDA and cash in favour of capital return. It’s about challenging telecoms’ current internal decision making processes and resetting their expectations in order to get the EBITDA multiples they are looking for. Though growth opportunities still exist, it’s simply not the same playing field as in decades past. Senior telecom leadership teams can’t just control costs – their priority should be on creating value. It’s time for telecoms to embrace capex best practices and not rely on the familiar measures of the past