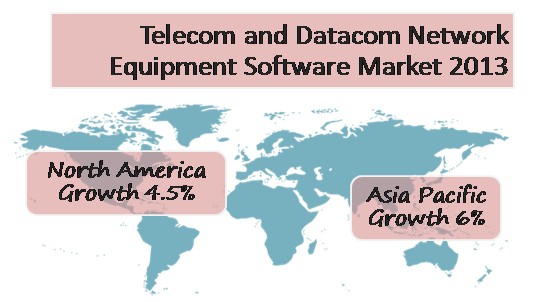

Infonetics, a leading market research firm, released the Telecom and Datacom Network Equipment and Software report to show the growth trends of telecommunications sector's biggest infrastructure segment. According to the report excerpts released by Infonetics, the worldwide sales of telecom and datacom equipment and software expanded another 3 % last year to a total of $183 billion in 2013 with the Asia Pacific outdoing North America in terms of growth. Asia Pacific grew 6% compared to 4.5% growth recorded by the North American market and is expected to keep up similar momentum for the next 3 years.

According to Infonetics, the segment is expected to rake in a total of $1.01 trillion in the next 3 years until 2018 with Cisco, Huawei, Ericsson, Alcatel-Lucent, and ZTE being the top players. For the enterprise segment, the biggest market share is held by Cisco, followed by Avaya, Brocade, HP, and Juniper, with a relatively smaller market share each. The report tracked 11 major categories of equipment and software including broadband aggregation; broadband CPE; pay TV; optical network hardware; carrier routing, switching, and Ethernet; service provider VoIP and IMS; service provider mobile/wireless infrastructure; service enablement and subscriber intelligence; security; enterprise and data center networks; and enterprise communications.

“Despite the fact that enterprises and service providers are in the middle of massive network upheavals due to the evolution of software-defined networking (SDN) and network functions virtualization (NFV) technology, the telecom and datacom networking equipment and software market is on track to grow annually through 2018 with the fastest growth coming in 2015.”

- Jeff Wilson, Principal Analyst at Infonetics Research

“Looking at just the service provider equipment space, we’re seeing a shakeup in vendor market share, with Huawei leapfrogging longtime number-one Ericsson to take the top spot in 2013. While Huawei’s been doing well in a number of regions, China’s economy is a key factor keeping Huawei’s growth so strong.”

- Michael Howard, Co-founder of Infonetics and co-author of the report