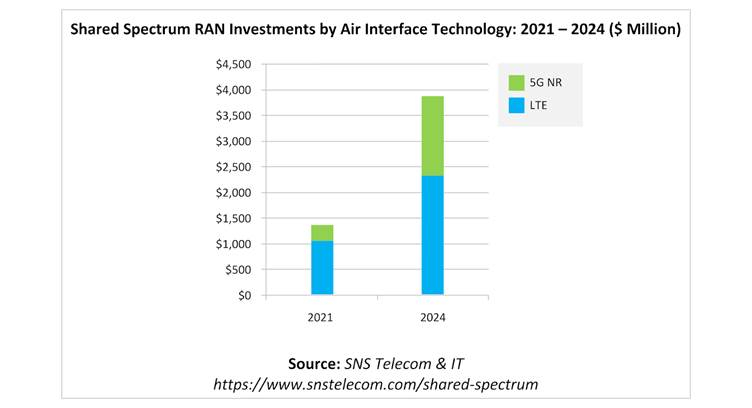

Annual spending on 5G NR and LTE small cell RAN infrastructure operating in shared spectrum will reach nearly $4 Billion by 2024 to support a variety of uses including private cellular networks for enterprises and vertical industries, densification of mobile operator networks, FWA and neutral host connectivity, according to SNS Telecom & IT's latest research report.

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum – frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum, most notably the United States' three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany's 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom's shared and local access licensing model, France's 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands' local mid-band spectrum permits, Japan's local 5G network licenses, Hong Kong's geographically-shared licenses, and Australia's 26/28 GHz area-wide apparatus licenses. Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

In addition, the 3GPP cellular wireless ecosystem is also accelerating its foray into vast swaths of globally and regionally harmonized unlicensed spectrum bands. Although existing commercial activity is largely centered around LTE-based LAA (Licensed Assisted Access) technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, the introduction of 5G NR-U in 3GPP's Release 16 specifications paves the way for 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation.

Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in 5G NR and LTE small cell RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.