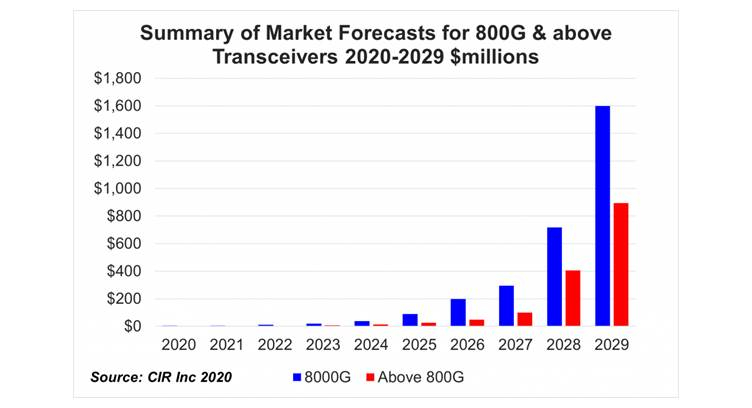

The market opportunity for 800 Gbps transceivers (800G) and above will reach $245 million in revenues by 2025 with ramp up to $2.5 billion by 2029, according to a report by Communications Industry Researchers (CIR).

Driven initially by video, CIR expects the traffic in data centers will be further driven by 5G and IoT applications requiring data center infrastructure to be rebuilt using 800G interfaces.

CIR sees 800G being used for interbuilding connectivity but will become a necessity for data centers that make significant use of 200G servers. CIR also sees some pioneer efforts to build the first few public network 800G links using technology that is somewhat proprietary to the equipment makers.

According to Lawrence Gasman, author of this new 800 Gbps transceivers report and President of CIR, ”800G represents a new era in optical networking speeds and latencies to accommodate the substantial uptick in video conferencing, streaming and digital entertainment as well new applications including virtual reality, augmented reality and artificial intelligence services.”

According to CIR, commercial 800G modules will be available in the next couple of years. This means that the 800G “revolution” is an event we can expect to happen soon. Previous generations of modules have been 10x efforts – 10G to 100 G. 800G can be implemented quite quickly because it can be achieved in effect be gluing 400G modules together.

The 800G public network market will never be a large one, said CIR. Here transceivers will be marketed as part of larger systems packages. They will be proprietary so that the equipment companies can squeeze as many features as possible out of their boxes in order impress the large telcos, which is not an easy thing to do. In the context of public networks, the companies that matter in terms of 800G trials are Ciena, Huawei, and Infinera. But given political realities Huawei’s market will largely limited to China and countries in China’s sphere of influence, said the market research firm.