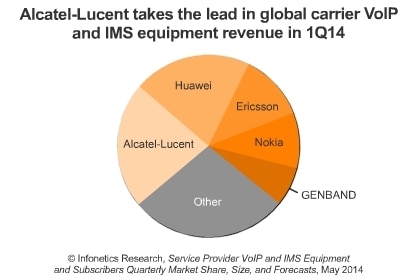

According to the report, Alcatel-Lucent, Huawei, Ericsson, Nokia and GENBAND are the top five vendors in the global carrier and IMS equipment segment in terms of revenues, making up almost three fourths of the market. The report highlighted that the rise in Voice over LTE (VoLTE) is the major driver for the demand for the segment. Infonetics also shared the following key points from the report:

Worldwide service provider VoIP and IMS equipment revenue totaled $992 million in 1Q14, an increase of 37% from 1Q13, but a sequential decline of 9%

-

-

Most segments were down on a sequential basis following a strong 4Q13

-

-

The core IMS and voice application server segment posted the strongest growth in 1Q14, continuing to be driven by VoLTE activity in the large North American and Asian markets

-

All regions are up on a year-over-year basis in 1Q14, with Asia Pacific and North America forming the foundation for the IMS rise due to activity from mobile operators

-

The standout vendor in 1Q14 is Alcatel-Lucent, rising to the top due to strong growth of core IMS and voice application server revenue, particularly in North America.

"Voice over LTE (VoLTE) continues to positively impact the service provider VoIP and IMS equipment market, though we look for the market to slow this year as operators commercially launch services and draw down capacity built over the past year. Already this year we have seen AT&T, PCCW/HKT, and other operators launch VoLTE services, and NTT DoCoMo is set to do so in June. There will be additional launches in 2014 by large and small providers alike that will hit the bottom line, but mobile does not completely dominate the picture. Spending on Class 5 replacement and voice over broadband (VoBB) and SIP trunking expansion will continue.”

- Diane Myers, Principal Analyst for VoIP, UC and IMS, Infonetics Research