Mobile operators are under growing pressure to change. Over the past few years, subscriber and revenue growth has remained flat at around 5% and 2%. Telcos usually focus on new subscriber growth and ignore churn, as long as the net result is positive. But what happens when everyone already has a phone and there are no new subscribers to get? There are a few key factors that signal the need for a change in strategy:

Lowering pricing to get new customers on board can have disastrous results. In India, this has resulted in significant decline of revenue for all companies on the market. It should feel quite obvious, but constant lessening of prices becomes unprofitable.

Mobile data does not lead to revenue growth. Data consumption is growing, but over 60% of it is already on Wi-Fi. With companies like Google pushing for free data, less people are willing to pay for it.

The emergence of eSims means subscribers have no reason to stay loyal to their provider. Will telcos die out as eSims become increasingly popular?

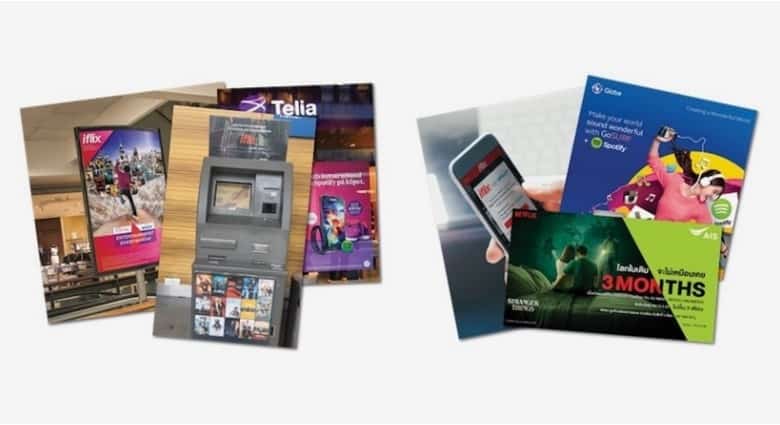

Telcos have attempted to resolve the “dumb pipe” challenge. First, by building out their own digital services, such as owned app stores and streaming services. Most of these have not panned out. By now, most telcos have partnered up with the likes of Google, Spotify and Netflix. These companies now the telco infrastructure to deliver these services to consumers.

The pressure on the existing business model of telcos continues growing. App store and VOD partnerships have proven to be a successful approach in increasing customer loyalty. What other areas could telcos leverage this approach in? For 2018, we see key areas where big changes are likely to happen.

#1: TELCOS AS BANKS

In emerging markets, banks are still incapable of reaching most users. Between 30% and 70% of people in developing economies do not have an account at a financial institution. The shift from banks to telcos as financial service providers is nothing new, as M-Pesa in Africa is turning 10 this year.

But it’s the quality and breadth of the services that telcos will most likely innovate in during 2018. Local money transfers are the start. There are also branded payment cards, international remittances, insurance services and micro-loaning.

Switching to a competing telco due to cheaper pricing is commonplace. Switching your bank account provider happens much less. The good thing is, telcos don’t need to build out the services on their own. Card issuers support white-labelling. As do insurance companies, and the same with credit scoring. 3rd parties already provide the content with digital bundling partnerships. Telcos can do the same with financial services. They can be providers of the "last mile" of connectivity, user acquisition and on boarding.

Fortunately for telcos, the partnership model can be applied here: card issuers support white-labelling, and there are a multitude of insurance and credit scoring companies out there who would be capable of bringing these services to consumers. Much like with payments and bundling for digital content, the role of the telco would be to provide the “last mile” of connectivity, user acquisition and on boarding.

Fintech has the biggest potential in developing markets due to the lack of traditional banking services. But it can also have potential in Western markets. When reaching a certain age, all minors receive two things - a bank card and a mobile phone. It would only be logical if telcos attempted to tap into new customers on both fronts.

#2: TELCOS AS PLATFORMS

Martin Koppel,

CEO & Co-Founder,

Fortumo

A copy-pasted argument about the modern digital ecosystem has been doing the rounds on the internet for the past year or so. It goes as follows:

"The world’s largest taxi firm, Uber, owns no cars. The world’s most popular media company, Facebook, creates no content. The world’s most valuable retailer, Alibaba, carries no stock. And the world’s largest accommodation provider, Airbnb, owns no property. Something big is going on."

Facebook would not be at 2 billion active users if it was responsible for content creation. Airbnb would have a valuation of $31 billion if they started building out rental units. For telcos, this could mean: “The world’s most valuable mobile operator offers no services”. Telcos do not need to always create new services on their own to grow.

Instead, telcos could find success in opening their platforms to everyone. PayPal did this by shifting away from only operating on eBay. Today, they provide payments (including alternative ones) to the entire online commerce industry. Telcos have a lot of channels, capabilities and data related consumers. Billing, identity, location, sales and marketing presence are a few. Telcos have so far underused this and given access to a select few partners.

Thus, the second approach telcos could take in 2018 would be to bring scale to their services. Telcos need to create self-service platforms where anyone can tap into their capabilities. This approach has worked across transportation, social media, online commerce and accommodation. Would it not work for telecommunications? It would bring new services to their subscribers. And as a result, user churn would reduce and stickiness increase.

Telcos don't need to create their own services. Rather, they could invest in creating open platforms, monetise them and bring new services to subscribers. Compliance and consumer data protection in creating these self-service platforms are key.

#3: TELCOS AS MARKETING POWERHOUSES

Telcos need to start monetising their marketing capabilities. Most communication in channels currently focuses on promoting own services. If we take a step back and remove telecommunication services from a telcos business, what do we have? A huge advertising network. Help desks, online and offline ads, social media, newsletters, call centres, retail locations. Telco services are also a lifelong need and with the number of mobile subscribers growing. These channels and loyal users are something other companies would want to reach as well. whether with paid advertising or through co-branding activities.

Should the shift happen to bring more 3rd party services on board, telcos can also monetise their marketing know-how. The approach would work in two ways. Telcos can sell local expertise to international companies looking to enter the market. And vice versa, international experience is valuable to local companies seeking to expand. Telcos are already doing the latter with start-up accelerator programs. But they have not yet tapped into opportunities with foreign companies.

About The Author:

Martin has been managing Fortumo’s business development and growth activities from launch to today, where the company works with over 170,000 merchants and 350 mobile operators in more than 100 countries. He makes sure Fortumo’s strategy is focused on helping its partners acquire, monetize and retain users. Martin frequently speaks at industry events and shares thoughts on the future of the digital ecosystem in media.