For as long as one can remember, service contracts have guaranteed short term revenue stability for Operators. Imagine having 25 million mobile subscribers in December with a monthly revenue of US$750 million with the Operator's costs running at around US$400 million. A superb too-good-to-be-true offer from a competitor then appears in the market, and subscribers start switching over, and come June, the subscriber figure drops to 18 million. The Operator's costs however, continue to hover around the US$400 million as most Operators sit on huge infrastructure and software investment and operation costs that cannot be shaken off just like that. The result? Profits slide massively. Of course, the Operator may then retaliate with better offers and massive campaigning, and eventually re-acquire his customers, restoring revenues and profit margins, but there is no guarantee that the cycle will not repeat itself.

The stickiness in Operators' costs is rooted in the way these costs are structured. Despite the hype on virtualization of networks and the push for leaner organizations, an Operator's Balance Sheet continues to feature every server, equipment, line, tower and cell that is used to deliver the service to the end user. The reason for this is obvious. The industry, for the past 20 years, has been going through revolutionary changes, not just because Qualcomm, Apple and Samsung and software giants such as Google and Microsoft keep churning out better and stronger mobile devices, but because mobile networks and the services enabled via these networks themselves have evolved rapidly.

Come 2020, 5G networks are expected to be rolled out commercially in a handful of countries, and more than half of mobile subscribers around the globe are expected to be using the 4G LTE service. At the same time, Operators are continuously expanding their footprint - both cellular and Wi-Fi, and are intensifying their coverage in most urban locations. To these, newer service delivery technologies - for example, VoLTE, VoWiFi, RCS and LTE Multicast - are adding further investment and operational layers. Complementing these are service platforms - IoT/M2M, Mobile Payments, Cloud Services - to name a few. To top everything off, we see increasing deployments of intelligent software solutions (BSS, PCRF, Network Optimization), including Virtualized Network Functions, that are becoming crucial in enabling Operators to launch more targeted and customized, and highly relevant plans and services covering innovative offers such as multi-screen services, contextual offers, dynamic pricing, data rollover, content bundling etc. All in all, network costs continue growing, and these and other fixed costs involved in delivering mobile services, such as customer service costs, internal staff costs, IT costs and to a certain extent, interconnect costs have contributed to a relatively rigid cost structure for Operators.

With the mobile industry's growth phase continuing to extend beyond the typical 15-20 years seen in other industries, these rigid cost structures are expected to remain (and expand) for a foreseeable future, which is why, service contracts, and the short term revenue stability they assure, have become important features for the sustainability of the business. Post-paid plans (both voice and data) come with a contract tenure, in return for per-unit fixed rates throughout the contract period. Similar contracts have since been extended to device plans, where subscribers acquire the ownership of the device (sold by the Operator), and owe the operator monthly installments over a pre-agreed contract period. Though the contracts mimic hire-purchase agreements, most device plans are essentially financing schemes where Operators lend the cash needed to purchase the device, while customers as borrowers, make monthly installments that include a small premium, which is the imputed interest cost on the borrowed sum. Both plan and device contracts have contributed to either reduced or delayed churn, ensuring no short term fluctuations in subscriber numbers and hence, unanticipated peaks and lows in Operator revenues.

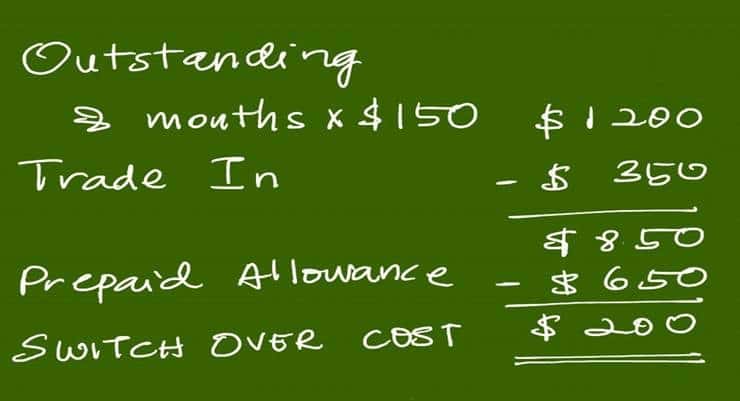

While this has been the general trend in the industry, this week, T-Mobile, the 4th largest operator in the US, announced a follow up to its Contract Freedom program, an initiative that aims to encourage subscribers to switch to its network by offering to reimburse the penalty incurred on breaking their mobile service contracts. The first part of the program, launched last year, offered new subscribers registering with T-Mobile, a reimbursement for the penalty payable for early termination of their service contracts. T-Mobile claims that the move helped the Operator to become the fastest growing wireless company in the US with a net add of 8.3 million customers. In its latest announcement this week, T-Mobile said that the new offer, which it terms 'Carrier Freedom', will see the extension of the scheme to device plans, granting new subscribers up to US$650 in reimbursements (for up to 10 devices) to cover the remaining installments for purchases of devices made from their existing Operators. New subscribers can trade-in their existing devices and sign up on new device plans with T-Mobile while receiving the reimbursements in the form of prepaid credit, said the company, .

T-Mobile, which touts itself as the 'Un-carrier', a term it uses to describe its line-up of initiatives (the latest being Un-carrier 9.0) aimed at redefining the service practices within the mobile industry, specifically in the way service plans are designed, also announced the 'locking' of rates for its 'Simple Choice' plan subscribers, guaranteeing the current rates indefinitely, as long as subscribers remain its customers and keep their plan. The offer, which T-Mobile calls the 'Un-Contract' program, also guarantees the locking in of data rates for its 4G LTE customers on unlimited plans, for a duration of 2 years, it said. A typical plan at T-Mobile gives up to 10GB of 4G LTE data for US$100 with sharing for up to 4 lines.

T-Mobile's latest Un-carrier move could spell the beginning of contract-less services by Operators. If the cost of switching over is so minimal, more customers will be inclined to move to another Operator when a good offer comes up. While transaction costs will be an inhibitation, bargains and seasonal offers as well as new content deals could attract a substantial number of subscribers to switch more frequently, creating nomadic customer groups (facilitated maybe by 'switch-friendly' devices such as Apple's iPad Air 2 and iPad Mini 3 which allow Operator-switching at the touch of a button) which will then render contracts ineffective. If this happens, contracts will soon start losing their value proposition, and in their place and in Operators' bid to avoid short term revenue fluctuations, innovative and highly effective customer engagement and retention schemes may start to emerge. Time to wait and see.