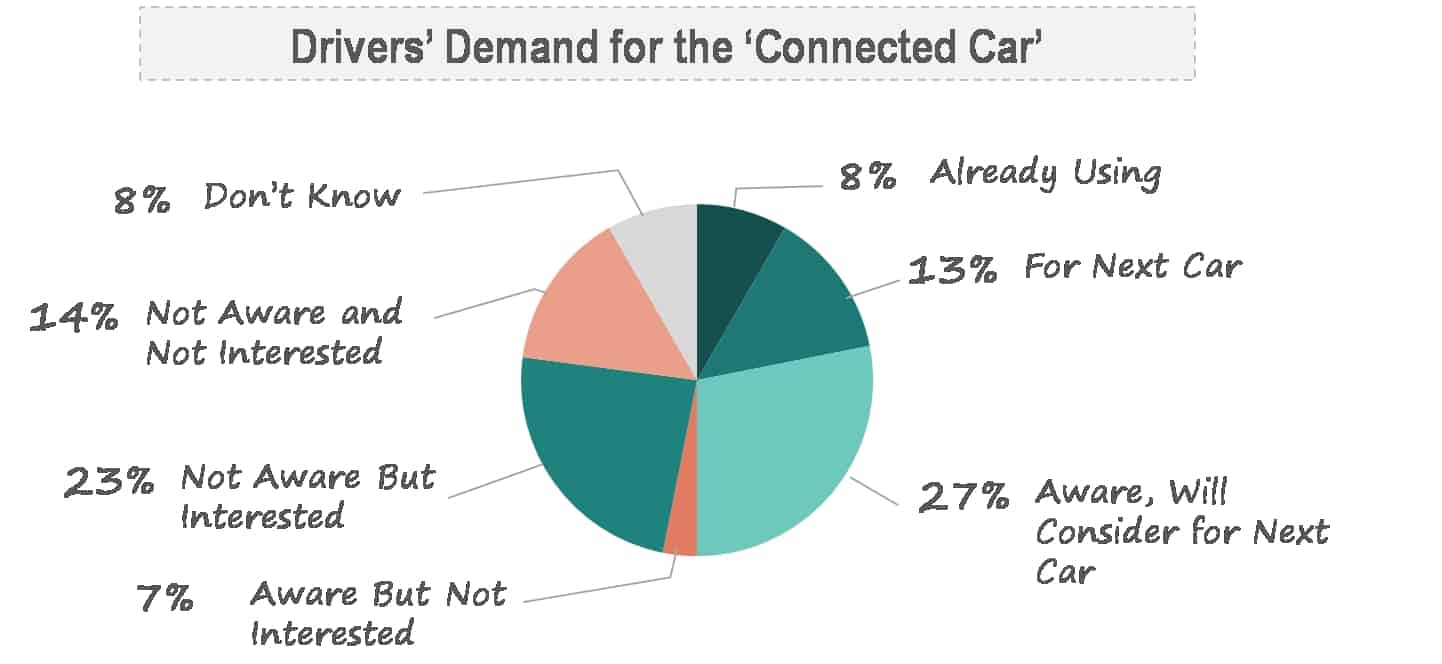

Telefonica, the world's largest communications service provider shared the findings of its Connected Car Industry Report 2014, highligting that 71% of drivers are already using or are keen to use the 'Connected Car' services.

The 'Connected Car' expands the Internet-of-Things which sees more and more machines and appliances becoming connected to the network. The connected car, interestingly, works in a more unique way. While most 'machines' including haulage vehicles are fitted with M2M connectivity capabilities, passenger cars offer both this type of direct connectivity as well as the ability for drivers to onboard their existing devices onto their car's smart digital platform (read our recent post on "What if My Phone Doesn't Like My Car?"), connecting it to the network via the device's connection. While the former sees service providers working with auto-makers to launch a series of connected car services, such as the recent initiative by Turkcell's Connected Car Platform and Chevrolet's 4G LTE Wi-Fi Service, the latter sees players such as CarPlay and Android Auto working with auto-makers (for example, Volvo's partnership with Open Automotive Alliance) to create both proprietary and open source platforms that enable passengers to plug in their devices and replicate their smartphone experience onto their cars' dashboard touch screens while they are on the road.

Mobile Operators are expected to roll out more Connected Car services, given that the area is driving the most revenues within the M2M segment for Operators. The 'Connected Car' is expected to rake in revenues of more than USD16.9 billion by 2018, a 3 times growth compared revenues recorded in 2013.

Telefonica's report provides insights on how the Connected Car is evolving, the general trends as well as the preferences of the end-users in terms of applications and services. Telefonica's key findings from the report, which used inputs from independent primary research and contributions from 6 of the world's largest auto-makers are illustrated in the following infographics. The report is available here.

"Through looking at the connected car from a driver’s perspective, it’s clear that the demand for connected services in cars is unquestionable. Even though we’re just moving off of the starting line, people are ready for it and know what they want. But challenges to widespread roll-out remain. Many consumers currently think of connected car services in terms infotainment and WiFi, but this changes when they are made aware of the variety of options that the technology can offer. Safety and diagnostics appear to be the most attractive features to drivers, illustrating just how important factors such as road safety and vehicle maintenance are in consumer purchasing decisions."

- Pavan Mathew, Global Head of Connected Car at Telefónica

“We are seeing a drive from consumers to actually have the same level of connectivity in the car that they would have whilst walking down the street, whilst sat in their front room, whilst sat on public transport. So just because they are spending two, three hours a day in a car, they don't want to be disconnected from their normal life.”

- Ian Digman, General Manager, Nissan

"I see a huge expansion beyond legacy telematics such as vehicle health reports, safety and security, crash notifications into active safety and automated driving aspects. I also think vehicle-to-vehicle communication is going to grow very quickly in the next five years. The beauty of that technology is that the communication protocol can be used for a host of other services beyond vehicle communication, so it benefits the wider infrastructure too.”

- Henry Bzeih, Chief Technology Strategist, Kia Motors

“For us it comes down to the things that make the car a better vehicle. When we talk to customers about connectivity they say well it's a car and so what I need it to do are the things I bought a car for. They want it to be safer, more intelligent and more economical. Connectivity is a chance for OEMs to look at how we can help to reduce costs for customers and make cost of ownership lower by giving advice on how to drive more fuel efficiently, or helping you find the lowest cost source of fuel or the most efficient route. Can I, by providing data for things like usage based insurance or pay as you drive insurance, can I save you money on insurance?”

- Greg Ross, Director of Product Strategy and Infotainment, GM