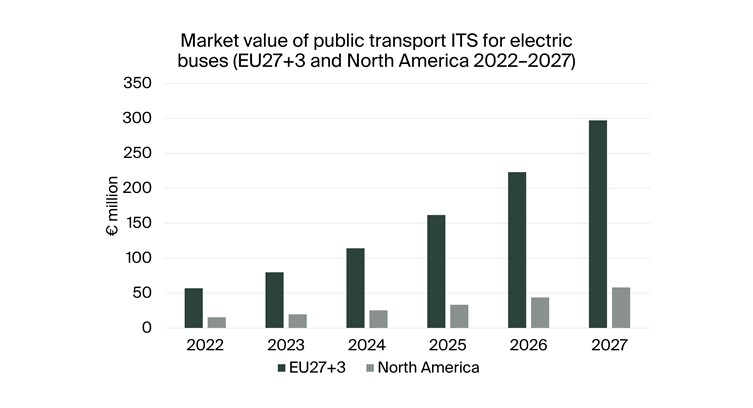

Berg Insight yesterday released new findings about the market for Intelligent Transport Systems (ITS) for electric buses. The market value for electric bus ITS deployed in European public transport operations was € 57.1 million in 2022. Growing at a compound annual growth rate (CAGR) of 39 percent, this number is expected to reach € 297.2 million by 2027. The North American market for electric bus ITS is similarly forecasted to grow at a CAGR of 30 percent from € 15.5 million in 2022 to reach € 58.2 million in 2027. Berg Insight is of the opinion that the market for ITS solutions for electric buses is in a growth phase which will last for several years to come. Mega-challenges such as urbanisation, climate change and traffic congestion continue to encourage investments in electric buses and ITS, contributing to a positive outlook for the market.

Some ITS players offer complete turnkey solutions including functionality for most of the ITS applications for electric buses utilised by public transport operators, but many vendors on the market are also specialised ITS players focusing on a few sub-systems. Major international ITS players such as INIT, IVU, Clever Devices and Trapeze can provide turnkey solutions, including solutions for electric buses. ITS providers are beginning to see larger scale implementations of electric bus fleets after several years of mostly pilot projects with only a few vehicles each. One of the leading telematics providers in Europe and North America for electric buses is ChargePoint, following its acquisition of Dutch ViriCiti in 2021. ChargePoint has increased its footprint in the fleet segment significantly and added both hardware and software solutions for the management of buses to its portfolio of charging station hardware, software and services. Other important vendors serving public transport companies with different types of solutions include the French group EQUANS through the subsidiary Ineo Systrans, as well as the Scandinavian companies Consat Telematics, FARA and Saga Tenix. The Canadian company GIRO is an important player in the scheduling and planning segment, while PSI Transcom is a prominent provider of depot and charging management software in Europe.

Source: Connected Infrastructure for Electric Buses - https://media.berginsight.com/2023/05/25143514/bi-electricbuses2-ps.pdf

Caspar Jansson, IoT Analyst, Berg Insight

Implementations of electric bus fleets are really starting to take off and there are already several cities in Europe with fleets operating over 100 electric buses. Operators face greater complexity with large electric vehicle fleets. Optimizing routes and supplying the required energy at the right time to the right vehicle is significantly easier with a modern ITS solution for electrified fleets