SD-WAN is happening, and it’s happening now!

How can service providers leverage the fast-growing SD-WAN market to maximize revenue and margin? The forecast for SD-WAN adoption over the coming years is high (92% of respondents in a 2020 Futuriom survey said they are evaluating SD-WAN services and/or software) and estimations of market value are extremely optimistic (ACG, for example, predict the market for managed SD-WAN to reach $2.5 billion in 2023). So, there is a huge opportunity here.

However, the source of SD-WAN value depends on who you are. For communication service providers, SD-WAN represents a good source of increased revenue when sold as a managed service while carriers can use SD-WAN services to make up for lost MPLS revenues. IT service companies catering to the enterprise market see an opportunity in SD-WAN to gain market share and keep enterprise customers loyal by introducing new, enhanced services while streamlining operations through centralized application management.

It is of no surprise, therefore, that in enterprise networks the shift from a traditional router and firewall setup to a secure SD-WAN is happening at a rapid pace. Yet, the buzz has already moved on to the next big thing in the networking evolution: the Secure Access Service Edge (SASE).

Moving forward: a seamless evolution

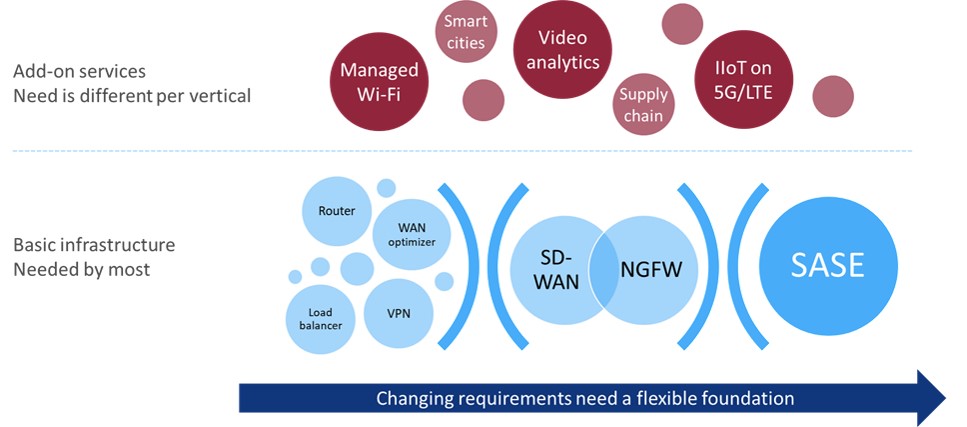

Based on the SASE approach, there is a general consensus that SD-WAN will evolve into a fundamental component of the SASE architecture which means that a continuous service development will take place. Service providers embracing the concept will need to support the evolution from simple routers to SD-WAN to SASE in a seamless manner, which is feasible because they are not essentially different nor disruptive services, but it will entail providing networking infrastructure to enterprises.

Significant flexibility is required to seamlessly evolve enterprise networking towards an SD-WAN/SASE architecture while also supporting the latest security features. This has prompted communication service providers to turn to universal customer premises equipment (uCPE) as the preferred service delivery platform. uCPE virtualizes traditional customer premises equipment and resides on commercial off-the-shelf (COTS) hardware. It enables complete services to be provisioned on-demand and managed centrally, rather than just the individual applications that are used to produce the service.

The commoditization of networking infrastructure

The SD-WAN market is dominated by a handful of vendors whose solutions solve the same issues using similar feature sets. Securely connecting employees, branches, applications and resources in an enterprise network is both a ubiquitous and generic need, which leads to conformity in managed service offerings. A service provider can try to differentiate their offering through service levels, local market knowledge, etc., but fundamentally, the service will not be very different from any other.

But why is this a problem? There are plenty of enterprises to sell to, and they increasingly prefer to buy networking as a managed service. The market is both big and growing, which implies that there should be enough opportunities to support a large number of service providers.

The issue is that when enterprise networking services become commoditized in this way, margins shrink. Add-on services, such as a better service level agreement (SLA) or a more advanced security option, equip service providers with a tool to segment customers and generate more revenue from each one, but as long as the add-ons are based on the same underlying networking solutions, margins will be limited.

Higher margins through innovative services

To successfully apply higher margins, service providers need to bring a more substantial differentiation to their offerings, with new services adding capabilities and running on top of the enterprise network rather than just enhancing it. It could, for example, be video analytics, private 4G LTE/5G networks, or MEC applications. These are services that use the underlying enterprise network to connect, and benefit from being co-located with networking applications, but are not themselves part of the actual network infrastructure.

Several reports indicate that enterprises are willing to try new services. For example, a recent survey showed that 87% of IT managers said they were likely or very likely to try new services if they could easily download and provision the services. The upsell potential for add-on services is therefore real if the services can be activated remotely and on-demand.

These are strong arguments in favor of uCPE. A flexible service delivery platform already in place at the edge, ready to activate new services, makes uCPE an obvious choice in the competitive managed SD-WAN landscape.

Who controls the uCPE (and revenue)?

An interesting question now arises: who will control the uCPE? Whoever it is will be in control of the services delivered on it and therefore also the revenue. There are several possibilities:

- Most carriers and operators already have an SD-WAN offering. As SD-WAN shifts traffic to broadband connections, these carriers will see their lucrative MPLS business shrink. Owning the uCPE and delivery of the services that run on top will enable them to create new sources of revenue. Indeed, many of them have already announced a uCPE based offering or have plans for it.

- IT service companies represent another group of potential service providers. Many already have an extensive background in enterprise networking services and are looking to defend and even expand their business. They are well placed to benefit from uCPE ownership. For IT service newcomers and start-ups, the business models that uCPE enables are an attractive opportunity and can be easily integrated into their offering.

- Enterprises themselves may want to have full control of their network and not give it up to a service provider. Typically, the owner of the uCPE would also build the services that run on top, but the decoupling of the white box and the services running on it, enabled by the virtualization layer, makes it possible to own the equipment and manage operations, but let someone else create the services.

Conclusion

uCPE is a service delivery platform that enables communication service providers to expand business with their customer base beyond the scope of SD-WAN in an easy and flexible way while also increasing margins on their services. The service provider who owns and controls the uCPE will be in pole position to deliver the add-on services and effectively keep competition out. So, service providers who have already made the move to SD-WAN or are planning to do so, should seriously consider deploying uCPE instead of fixed-function appliances as a means to securing their position and revenues with their customers.